The information listed is for informational purposes only. I am not an Attorney, and should you have questions you should consult a legal professional.

Trusts

Living trusts can avoid probate and reduce or eliminate federal estate taxes for your estate. This webpage provides details about living trusts, their benefits, and their problems.How can a living trust help your estate?

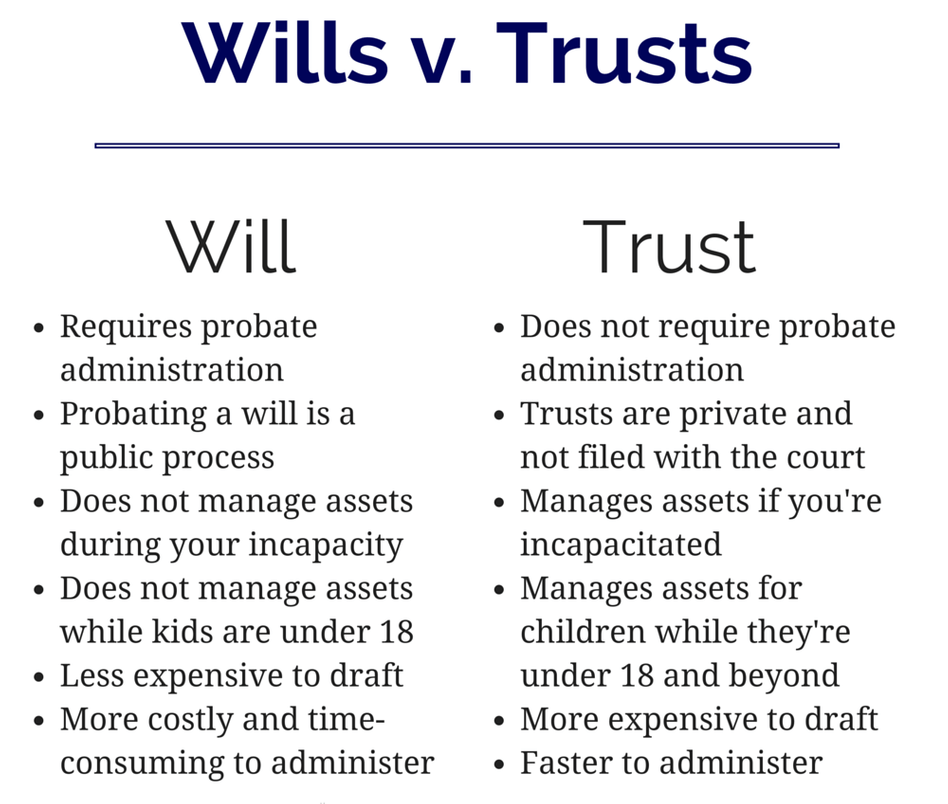

1. A living trust will avoid probate for all assets that have been transferred to the trust. Probate is a costly, time-consuming process that many estates do not need. However, there are some cases in which having a living trust will not provide protection against probate because the estate has few probate assets and probate is not required. Click here for more information: Keeping your estate out of probate.

2. A trust also can avoid a conservatorship, which is a court proceeding that is expensive, time-consuming and restrictive. Conservatorships are needed when an individual can no longer manage his or her financial affairs. A conservator is appointed by a court and given the power to manage the conservatee's financial affairs, and also make decisions concerning the conservatee's living arrangements. A properly prepared trust can provide a successor trustee who will manage the trust for the benefit of the trustor, sometimes avoiding the need for a conservatorship.

3. For married couples with estates subject to the federal estate tax, a living trust can reduce or eliminate federal estate taxes by setting up an Exemption Trust. Click here for more information: Exemption Trusts and Bypass Trusts

How is a living trust set up and funded?

1. A trust document is prepared that usually names the trustors (the persons who are setting up the trust) as the trustees of the trust. The trustees are responsible for managing the trust and its assets. The trust usually nominates other persons, banks, or trust companies as successor trustees. The successor trustee(s) will take over management of the trust after the death, resignation, or incompetency of the original trustee(s).

2. The trust also provides for distribution of the estates of the trustors after the deaths of both trustors. These provisions can be the same as those found in a will and might include trusts for younger beneficiaries, gifts to charities, etc.

3. Depending on the size of the estate, the trust might also include provisions that will reduce or eliminate federal estate taxes.

4. After the trust is signed, the trustors transfer their assets to the trust. If this is not done, additional legal work, possibly including a probate of these assets, will be required after the deaths of the trustors.

1. Assets held by the trust will not need to be probated. Legal fees for probating an estate are usually much higher than the fees for administering a trust. Probates can also take a year or longer to complete, but a trust administration usually can be completed in a much shorter time.

2. If a trustor becomes mentally incompetent, the successor trustee can take control of the trust and avoid the cost of a conservatorship in most cases. Conservatorships are often used in situations in which someone can no longer manage his or her own financial affairs or personal care. A conservatorship is a court-supervised proceeding that can involve substantial legal fees.

3. Federal estate taxes can be reduced or avoided. For more information about federal estate taxes, click here: Federal estate taxes

4. The trust is revocable during the lifetimes of the trustors. If an Exemption Trust is used, part of the trust will become irrevocable after the death of the first trustor.

5. The trust can also include a disclaimer trust, intended to reduce or eliminate federal estate taxes.

Disadvantages of living trusts:

1. Preparation of a living trust costs more than a will.

2. Transferring assets to the trust involves costs and paperwork not required for less elaborate estate plans.

3. Administration of an Exemption Trust can involve additional effort for the surviving spouse. For more information, click here: Trust Administration

4. Refinancing real property that is owned through a trust may require transferring the property out of the trust before the refinancing, and then putting it back into the trust. A few lenders do not require that property be taken out of the trust when it is refinanced.

Alliance Bay Realty

DRE#

3140 De La Cruz Blvd. #200-B

Santa Clara, CA 95054